一.效果

二.实现

1.按bt轮转框架格式,每列都是标的代码,获取数据

2.回测

2.1添加策略进行回测

import bt

from bt_algos_extend import SelectTopK

signal = data.pct_change(20)

# signal.dropna(inplace=True)

all = []

for K in [

1,

]:

s = bt.Strategy(

"bt_创业成长+红利低波_动量轮转K={}".format(K),

[

SelectTopK(signal, K), # 先选最好的k个

bt.algos.WeighEqually(), # 等权

bt.algos.Rebalance(), # 重新平衡

],

)

all.append(s)

stras = [bt.Backtest(s, data) for s in all]2.2也可以添加比较基线

for bench in ["000300.SH"]:

data = CSVDataloader.get([bench])

s = bt.Strategy(

bench,

[

bt.algos.RunOnce(), # 执行一次

bt.algos.SelectAll(), # 选择所有

bt.algos.WeighEqually(),

bt.algos.Rebalance(),

],

)

stra = bt.Backtest(s, data)

stras.append(stra)

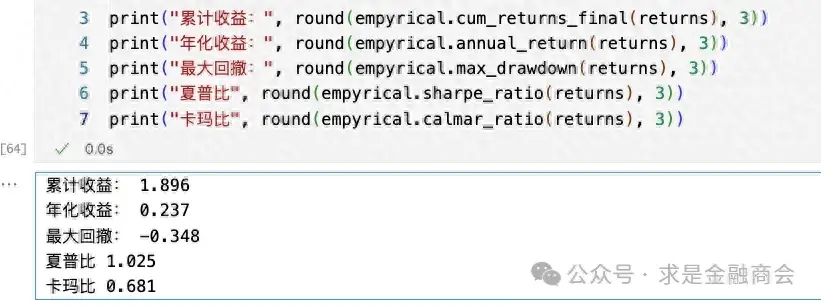

res = bt.run(*stras)3.获取回测数据进行分析

# 获取每日收益

returns = res['bt_创业成长+红利低波_动量轮转K=1'].returns

import empyrical

print("累计收益:", round(empyrical.cum_returns_final(returns), 3))

print("年化收益:", round(empyrical.annual_return(returns), 3))

print("最大回撤:", round(empyrical.max_drawdown(returns), 3))

print("夏普比", round(empyrical.sharpe_ratio(returns), 3))

print("卡玛比", round(empyrical.calmar_ratio(returns), 3))

import quantstats as qs

qs.reports.basic(returns)

发布者:股市刺客,转载请注明出处:https://www.95sca.cn/archives/281597

站内所有文章皆来自网络转载或读者投稿,请勿用于商业用途。如有侵权、不妥之处,请联系站长并出示版权证明以便删除。敬请谅解!

![[通达信指标]小财神择时附图公式](https://95sca.cn/2024/08/07/nHgdjPAbseMkgpg1722994996.8070917.jpg?imageMogr2/thumbnail/!480x300r|imageMogr2/gravity/center/crop/480x300)

![[ML]TabPFN: 一种基于因果推理的先验数据拟合分类算法](https://95sca.cn/2024/08/07/HicCF60TkicC7Dw1722992827.91685.jpg?imageMogr2/thumbnail/!480x300r|imageMogr2/gravity/center/crop/480x300)

![[通达信指标]主图追买逃顶](https://95sca.cn/2024/08/07/xuL4pxR0e5kvaJw1722998124.1010044.jpg?imageMogr2/thumbnail/!480x300r|imageMogr2/gravity/center/crop/480x300)