一.效果

二.具体实现

1.实现海龟交易类

class TurtleStrategy(bt.Strategy):

# 默认参数

params = (

("long_period", 25),

("short_period", 15),

("printlog", False),

)

def __init__(self):

# 初始化订单信息

self.order = None

# 买入价格

self.buyprice = 0

# 买入手续费

self.buycomm = 0

# 买入数量

self.buy_size = 0

# 买入次数

self.buy_count = 0

# 计算唐奇安通道的上轨线

# 海龟交易法则中的唐奇安通道和平均波幅ATR

self.H_line = bt.indicators.Highest(

self.data.high(-1), period=self.p.long_period

)

# 计算唐奇安通道的下轨线

self.L_line = bt.indicators.Lowest(

self.data.low(-1), period=self.p.short_period

)

# 计算真实波幅TR

self.TR = bt.indicators.Max(

(self.data.high(0) - self.data.low(0)),

abs(self.data.close(-1) - self.data.high(0)),

abs(self.data.close(-1) - self.data.low(0)),

)

# 计算平均波幅ATR

self.ATR = bt.indicators.SimpleMovingAverage(self.TR, period=14)

# 判断价格是否上穿上轨线,生成买入信号

# 价格与上下轨线的交叉

self.buy_signal = bt.ind.CrossOver(self.data.close(0), self.H_line)

# 判断价格是否下穿下轨线,生成卖出信号

self.sell_signal = bt.ind.CrossOver(self.data.close(0), self.L_line)

def next(self):

if self.order:

return

# 判断是否满足入场条件:价格突破上轨线且空仓

# 入场:价格突破上轨线且空仓时

if self.buy_signal > 0 and self.buy_count == 0:

# 计算买入数量

self.buy_size = self.broker.getvalue() * 0.01 / self.ATR

self.buy_size = int(self.buy_size / 100) * 100

# 设置买入数量

self.sizer.p.stake = self.buy_size

# 买入计数加1

self.buy_count = 1

# 输出空仓时买入的信息

print("空仓时买入", self.buy_size)

# 执行买入操作,并保存订单

self.order = self.buy()

# 判断是否满足加仓条件:价格上涨了买入价的0.5的ATR且加仓次数少于3次(含)

# 加仓:价格上涨了买入价的0.5的ATR且加仓次数少于3次(含)

elif (

self.data.close > self.buyprice + 0.5 * self.ATR[0]

and self.buy_count > 0

and self.buy_count <= 4

):

# 输出加仓买入的信息

print("加仓买入")

# 计算加仓数量

self.buy_size = self.broker.getvalue() * 0.01 / self.ATR

self.buy_size = int(self.buy_size / 100) * 100

# 设置加仓数量

self.sizer.p.stake = self.buy_size

# 执行加仓操作,并保存订单

self.order = self.buy()

# 加仓计数加1

self.buy_count += 1

# 判断是否满足离场条件:价格跌破下轨线且持仓

# 离场:价格跌破下轨线且持仓时

elif self.sell_signal < 0 and self.buy_count > 0:

# 输出平仓信号卖出的信息

print("平仓信号卖出")

# 执行卖出操作,并保存订单

self.order = self.sell()

# 清空买入计数

self.buy_count = 0

# 判断是否满足止损条件:价格跌破买入价的2个ATR且持仓

# 止损:价格跌破买入价的2个ATR且持仓时

elif self.data.close < (self.buyprice - 2 * self.ATR[0]) and self.buy_count > 0:

# 输出止损信号卖出的信息

print("止损信号卖出")

# 执行卖出操作,并保存订单

self.order = self.sell()

# 清空买入计数

self.buy_count = 0

# 交易记录日志(默认不打印结果)

def log(self, txt, dt=None, doprint=False):

# 如果参数printlog为True或者doprint为True

if self.params.printlog or doprint:

# 如果dt为空,则使用self.datas[0].datetime.date(0)作为默认值

dt = dt or self.datas[0].datetime.date(0)

# 打印日志,格式为日期和txt

print(f"{dt.isoformat()},{txt}")

# 记录交易执行情况(默认不输出结果)

def notify_order(self, order):

# 如果order为submitted/accepted,返回空

if order.status in [order.Submitted, order.Accepted]:

return

# 如果order为buy/sell executed,报告价格结果

if order.status in [order.Completed]:

if order.isbuy():

# 买入

self.log(

f"买入:\n价格:{order.executed.price},\

成本:{order.executed.value},\

手续费:{order.executed.comm}"

)

# 更新买入价格

self.buyprice = order.executed.price

# 更新买入手续费

self.buycomm = order.executed.comm

else:

# 卖出

self.log(

f"卖出:\n价格:{order.executed.price},\

成本: {order.executed.value},\

手续费{order.executed.comm}"

)

# 更新已执行条数

self.bar_executed = len(self)

# 如果指令取消/交易失败, 报告结果

elif order.status in [order.Canceled, order.Margin, order.Rejected]:

self.log("交易失败")

# 清除订单

self.order = None

# 记录交易收益情况(可省略,默认不输出结果)

def notify_trade(self, trade):

# 判断交易是否已关闭

if not trade.isclosed:

# 如果未关闭,则返回不执行后续操作

return

# 输出策略收益信息

self.log(f"策略收益:\n毛收益 {trade.pnl:.2f}, 净收益 {trade.pnlcomm:.2f}")

def stop(self):

# 打印日志,显示组合线参数和期末总资金

self.log(

f"(组合线:{self.p.long_period},{self.p.short_period}); 期末总资金: {self.broker.getvalue():.2f}",

doprint=True,

)2.添加TraderSizer

class TradeSizer(bt.Sizer):

params = (("stake", 1),)

def _getsizing(self, comminfo, cash, data, isbuy):

# 如果isbuy为真,则返回持仓数量

if isbuy:

return self.p.stake

# 获取当前持仓信息

position = self.broker.getposition(data)

# 如果持仓数量为0

if not position.size:

# 返回0

return 0

else:

# 返回持仓数量

return position.size3.回测

cerebro = bt.Cerebro()

cerebro.broker.setcash(100 * 10000.0)

cerebro.addanalyzer(bt.analyzers.PyFolio, _name="pyfolio")

data = bt.feeds.PandasData(dataname=df)

cerebro.adddata(data)

cerebro.addsizer(TradeSizer) #添加交易资金分配器

print("初始资金: %.2f" % cerebro.broker.getvalue())

cerebro.addstrategy(TurtleStrategy)

strats = cerebro.run()

print("期末资金: %.2f" % cerebro.broker.getvalue())4.分析

strat0 = strats[0]

pyfolio = strat0.analyzers.getbyname("pyfolio")

returns, positions, transactions, gross_lev = pyfolio.get_pf_items()

import empyrical

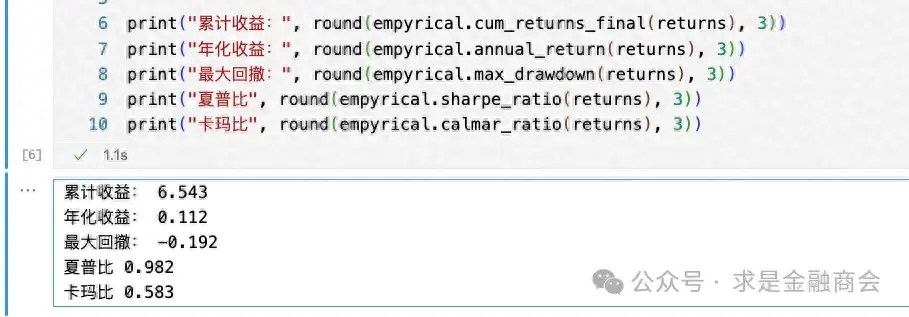

print("累计收益:", round(empyrical.cum_returns_final(returns), 3))

print("年化收益:", round(empyrical.annual_return(returns), 3))

print("最大回撤:", round(empyrical.max_drawdown(returns), 3))

print("夏普比", round(empyrical.sharpe_ratio(returns), 3))

print("卡玛比", round(empyrical.calmar_ratio(returns), 3))

发布者:股市刺客,转载请注明出处:https://www.95sca.cn/archives/281601

站内所有文章皆来自网络转载或读者投稿,请勿用于商业用途。如有侵权、不妥之处,请联系站长并出示版权证明以便删除。敬请谅解!

![[通达信指标]红买加仓主图公式](https://95sca.cn/2024/08/07/eH8Ziasx1zqarOg1722996832.8115747.jpg?imageMogr2/thumbnail/!480x300r|imageMogr2/gravity/center/crop/480x300)

![[通达信指标]江恩系列5 循环周期副图](https://95sca.cn/2024/08/07/3hdn4nuLx0Wwd4Q1722994943.7604322.jpg?imageMogr2/thumbnail/!480x300r|imageMogr2/gravity/center/crop/480x300)