一.效果

二.实现

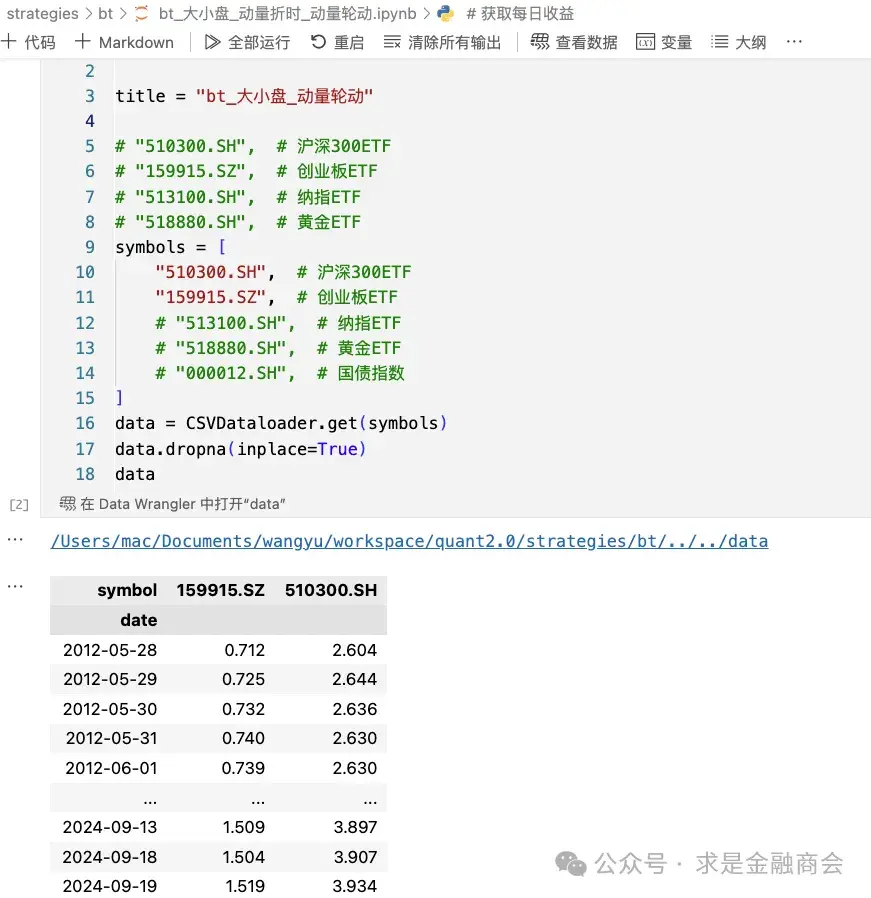

1.获取数据

2.设置排除因子,排序因子 ,回测

import bt

from bt_algos_extend import SelectTopK

# 1.排除因子 大于0.02买入,小于0卖出

factor = data.pct_change(20) # 20天涨跌幅

signal = np.where(factor > 0.02, 1, np.NaN)

signal = np.where(factor < 0, 0, signal)

signal = pd.DataFrame(signal, data.index, columns=factor.columns)

signal = signal.ffill()

signal = signal.fillna(0)

# 2.排序因子 动量因子

roc = data.pct_change(20) # 20天涨跌幅

all = []

for K in [

1,

]:

s = bt.Strategy(

"{}K={}".format(title, K),

[

bt.algos.RunDaily(),

bt.algos.SelectWhere(signal),

SelectTopK(roc, K), # 涨幅最好选前K个

bt.algos.WeighEqually(),

bt.algos.Rebalance(),

],

)

all.append(s)

stras = [bt.Backtest(s, data) for s in all]

for bench in symbols:

data = CSVDataloader.get([bench])

s = bt.Strategy(

bench,

[

bt.algos.RunOnce(),

bt.algos.SelectAll(),

bt.algos.WeighEqually(),

bt.algos.Rebalance(),

],

)

stra = bt.Backtest(s, data, name=bench)

stras.append(stra)

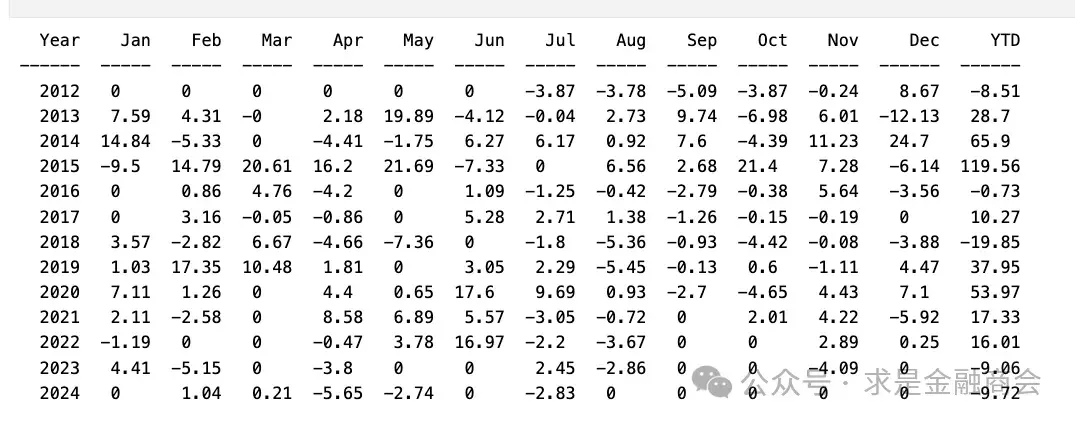

res = bt.run(*stras)3.回测数据分析

# 获取每日收益

s_name = title + "K=1"

returns = res[s_name].returns

res.display_monthly_returns(s_name)

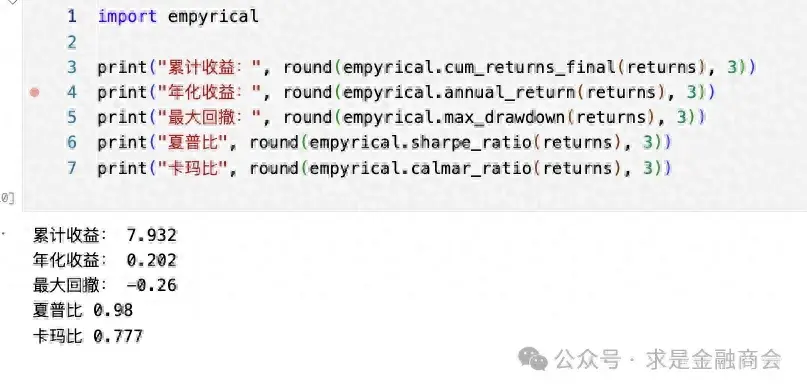

import empyrical

print("累计收益:", round(empyrical.cum_returns_final(returns), 3))

print("年化收益:", round(empyrical.annual_return(returns), 3))

print("最大回撤:", round(empyrical.max_drawdown(returns), 3))

print("夏普比", round(empyrical.sharpe_ratio(returns), 3))

print("卡玛比", round(empyrical.calmar_ratio(returns), 3))

import quantstats as qs

qs.reports.basic(returns)

发布者:股市刺客,转载请注明出处:https://www.95sca.cn/archives/281595

站内所有文章皆来自网络转载或读者投稿,请勿用于商业用途。如有侵权、不妥之处,请联系站长并出示版权证明以便删除。敬请谅解!

![[通达信画线指标]甘氏线 支撑压力](https://95sca.cn/2024/08/07/apTnF6znNMLocvg1722998778.6968474.jpg?imageMogr2/thumbnail/!480x300r|imageMogr2/gravity/center/crop/480x300)